A New Market Paradigm Is Taking Shape

The global photovoltaic (PV) industry is confronting a pivotal and complex challenge: the sharp surge in silver prices has fundamentally reshaped its cost structure. Industry data shows that silver’s share of module costs has skyrocketed, transforming it from a minor component into a primary cost driver. This shift, occurring alongside a significant decline in polysilicon prices, has completely disrupted traditional financial models. For the industry, this is no longer merely an issue of cost inflation but a structural “cost coup.”

The Great Divide: Scale as the Ultimate Competitive Moat

Amid this challenging environment, a clear divergence has emerged between industry leaders and smaller players. Leading manufacturers such as LONGi and JA Solar have announced price increases of 0.03 to 0.06 yuan per watt to partially offset the impact of soaring raw material costs. In stark contrast, many small and medium-sized enterprises (SMEs), lacking similar pricing power and supply chain bargaining capabilities, have been forced into production shutdowns. This dynamic underscores a crucial lesson for 2026: in an era of heightened economic uncertainty, the ultimate competitive moat lies not only in technology but also in pricing power and supply chain control—a principle already validated in the automotive sector by companies like BYD and now decisively playing out in solar.

Strategic Adaptation: Demand Destruction and Technological Substitution

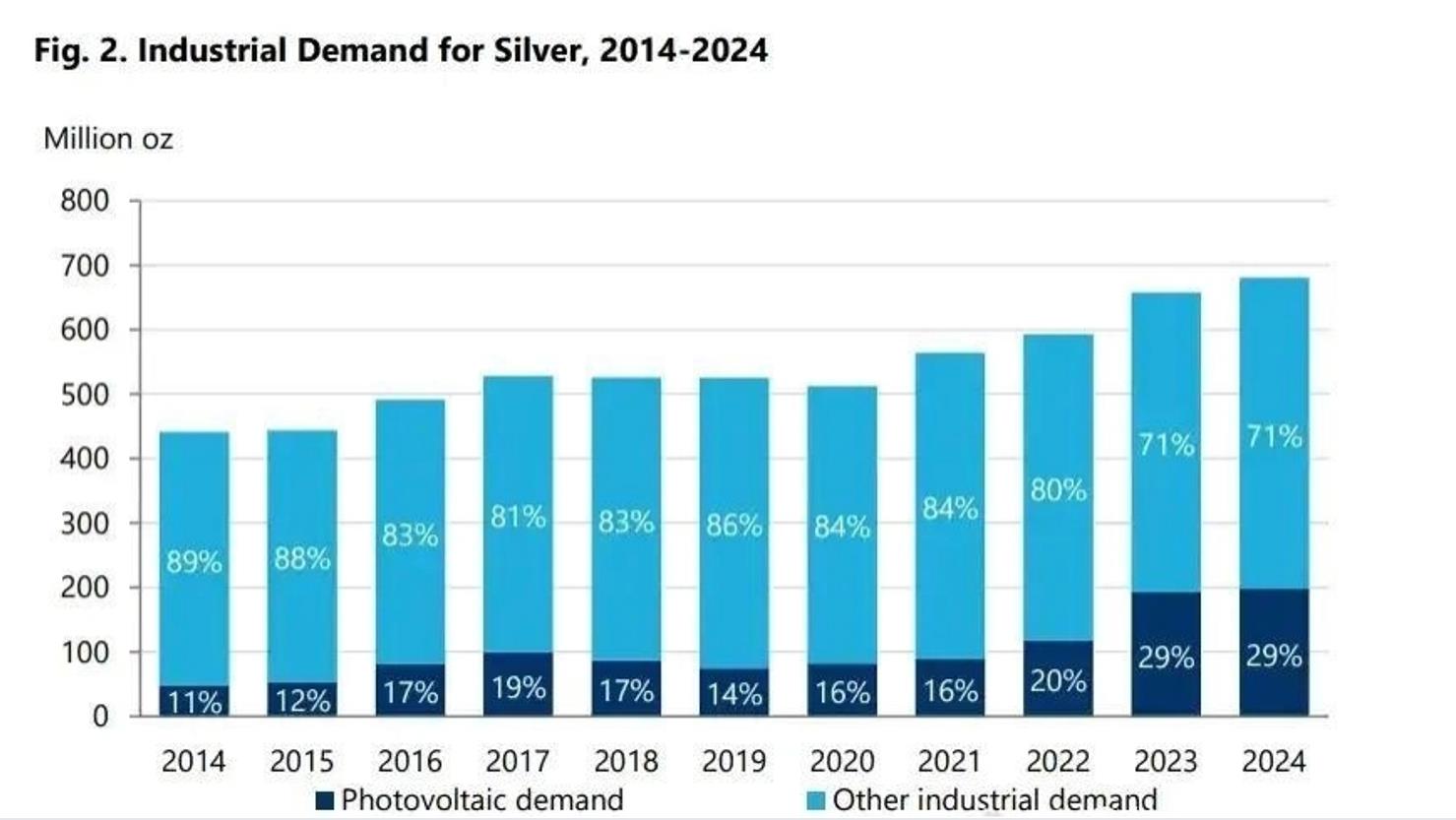

The rise in silver prices is triggering classic economic feedback mechanisms. PV manufacturers are responding by reducing silver usage, postponing purchases, and depleting inventories. According to analysis from Xueqiu, global PV silver demand is projected to contract by approximately 17% in 2026. More strategically, the industry is accelerating its shift toward silver-copper composite pastes and other low-silver metallization technologies. This move from pilot lines to mass production represents a long-term structural threat to the industrial demand for silver from its largest consuming sector. For PV manufacturers, proactively investing in next-generation cell technologies that minimize reliance on precious metals is no longer optional but a core strategic imperative.

Market Misalignment and the “Dual-Nature Silver” Thesis

Recent market data reveals significant discrepancies. While spot prices have risen sharply, physical holdings in major ETFs have experienced substantial outflows. Simultaneously, shifts in U.S. tariff policies have triggered a reversal in inventory flows, indicating that previous supply tightness was partly driven by hoarding rather than pure consumption. This suggests a growing divergence between silver’s financial narrative and its industrial fundamentals. Silver’s future trajectory may increasingly resemble that of gold, driven more by macroeconomic sentiment than anchored by robust, price-insensitive industrial demand from the PV sector.

Strategic Positioning for Multifit

For Multifit, navigating this new landscape requires a multifaceted strategy:

Supply Chain Resilience: Deepen partnerships and secure arrangements with key material suppliers to enhance cost stability and supply security.

Value-Based Competition: As the industry gradually moves beyond pure “scale and low-price competition,” we must compete through the value proposition of integrated solutions, technological advantages, and bankability.

Product Diversification: Reduce reliance on single-category products by further optimizing the advantages of the solar system maintenance products we independently develop and manufacture, aiming to capture the global market.

Market Agility: Leverage supportive policies such as China’s extension of tax exemptions for cross-border e-commerce returns to optimize global inventory management and mitigate risks associated with overseas operations.

Conclusion

The “Silver Shock” of 2026 is more than a commodity cycle—it is a stress test that reveals the fundamental rules of the current industrial era. It distinguishes companies with deep moats (scale, pricing power, and technological adaptability) from those vulnerable to market forces. For Multifit, this environment presents both a challenge and an opportunity. By decisively adjusting strategies, strengthening supply chains, and advancing technologies that will define the next generation of solar energy, we have the chance to solidify our leadership position.

Post time: Feb-10-2026