Core Export Data: Emerging Markets Drive Growth, Europe’s Share Declines

From January to November 2025, China’s solar panel exports exhibited a pattern of “emerging markets booming, Europe contracting.” According to InfoLink data, Jinko Solar (41.84GW), LONGi Green Energy (39.57GW), and JA Solar (33.79GW) ranked as the top three export brands, with overseas revenue accounting for over 40% for leading companies. The Middle East market saw the most rapid growth (a 99% year-on-year increase in 2024), with countries like Pakistan and Saudi Arabia becoming core incremental markets. African demand was also strong (a 43% year-on-year increase in 2024), with countries like South Africa and Egypt significantly increasing their imports. Emerging markets such as Brazil (accounting for 68% of Americas imports) and India (the largest importer in the Asia-Pacific region) continued to expand.

The European market, however, faced dual pressures: China’s component exports to Europe decreased by 7% year-on-year in 2024, with traditional markets like the Netherlands and Spain seeing declining shares. The main reasons include high inventory levels in Europe, policy restrictions such as the “Forced Labor Ban,” and Chinese companies accelerating the shift of production capacity to emerging markets like the Middle East and Africa.

Market Trends: Falling Prices and Diverging Demand Coexist

Intensified Price Competition Puts Pressure on Export Value

In the first 10 months of 2025, China’s solar battery export volume increased by 69.7% year-on-year, but the export value decreased by 11.9%. The main reasons were the continuous decline in global component prices (the average component price in August 2025 was about $0.19/W) and weak demand in traditional markets like Europe. However, demand for low-priced components in emerging markets supported export volume growth. For example, countries like Pakistan and India have promoted household photovoltaic adoption through subsidy policies.

Distributed Photovoltaics Become a New Growth Driver Overseas

The demand for distributed photovoltaics overseas is growing rapidly, especially in regions with weak power infrastructure. Examples include:

Pakistan: Solar equipment has been included in dowry lists, communication tower emergency power supplies are gradually being replaced by photovoltaics + energy storage, and the adoption rate of household photovoltaics in rural areas is increasing.

Africa: In July 2025, China’s component exports to Africa hit a record high ($135.8 million), with large-scale ground power stations and household markets in countries like South Africa and Algeria expanding simultaneously.

Policies and Challenges: Trade Barriers and Localization Pressure

Rise of Trade Protectionism

Europe plans to restrict Chinese component imports through the “Net-Zero Industry Act,” while the U.S. imposed a 54% tariff on Chinese products in April 2025 and included transshipment trade channels like Vietnam and Cambodia in the tariff scope, significantly increasing export costs for companies.

Urgent Need for Localized Production

To circumvent trade barriers, Chinese companies are accelerating the establishment of overseas factories.

Future Outlook: Dual Drivers of Emerging Markets and Technological Upgrades

In the short term, emerging markets such as the Middle East, Africa, and Latin America will continue to support export growth. It is estimated that China’s total component exports will exceed 250GW in 2025. In the long term, technological advancements (such as BC and Topcon batteries), integrated energy storage (e.g., Trina Solar’s cumulative energy

storage shipments of 12GWh), and the export of green solutions (e.g., Saudi Arabia’s 300,000-square-meter low-carbon urban complex project) will become core competencies for companies. At the same time, companies must address risks such as trade barriers and fluctuations in raw material prices, achieving sustainable development through localized production and diversified market strategies.

Multifit and the Photovoltaic Industry

Multifit is a national high-tech enterprise dedicated to the research, development, production, and sales of green energy such as solar power, as well as the construction and cleaning maintenance of photovoltaic power stations. Headquartered in Beijing, its production base is located in the National High-Tech Industrial Development Zone in Shantou, Guangdong, with a branch in Shenzhen. Its subsidiaries include Multifit Electrical, Multifit Solar, and Multifit Smart. Upholding the mission of “Efficient Energy Conservation, Enabling More People to Enjoy Green Energy,” the company is rooted in the photovoltaic industry and strives to become a leader in the photovoltaic power generation and robotic cleaning and maintenance sectors.

Multifit Solar’s Solar Energy System product M-ESS Series:

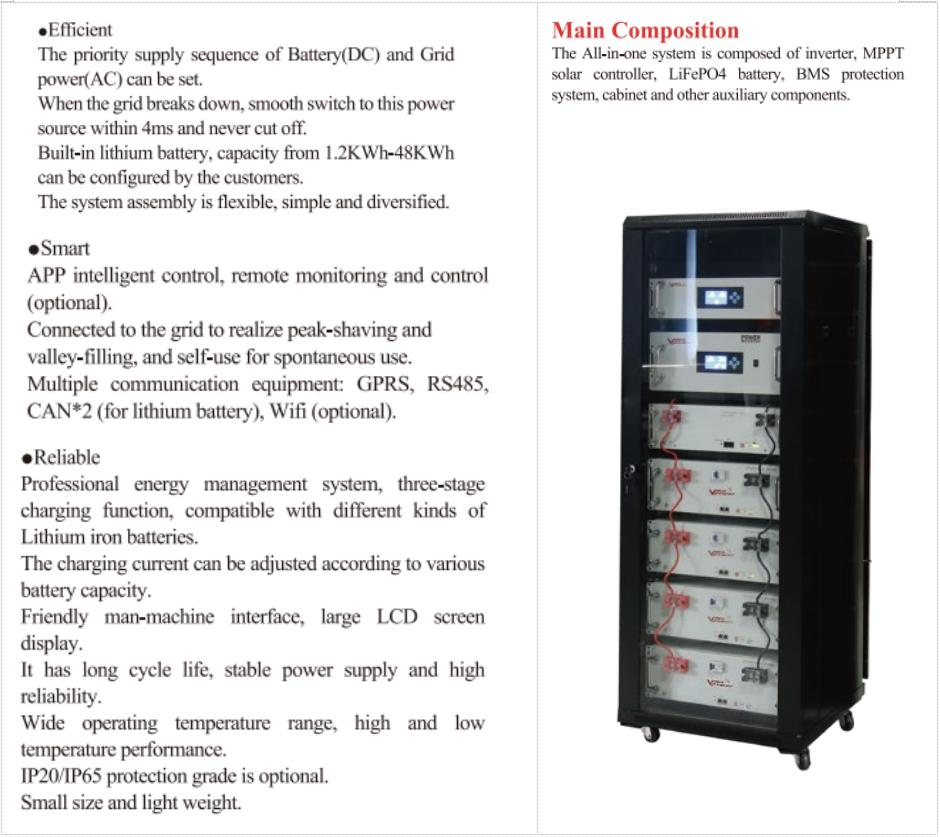

ALL-IN-ONE Solar&Lithium Battery Energy System

Grid-connected operation enables peak shaving, valley filling, and self-consumption.

Equipped with a professional energy management system and three-stage charging function, it is compatible with various types of lithium batteries.

Charging current can be adjusted according to different battery types.

Multiple communication options: GPRS, RS485, dual CAN ports (compatible with lithium batteries), and optional WiFi.

Wide operating temperature range with excellent performance in both high and low temperatures.

IP20/IP65 protection levels available.

Features a large LCD screen for clear display.

Post time: Dec-01-2025